Is Selling on Amazon Worth It? A Practical Guide for Founders

👀 TL;DR: Should I sell on Amazon? Even the most successful Amazon sellers will admit it’s a love/hate relationship. Selling on Amazon comes with its costs and difficulties, but also massive potential. So, is selling on Amazon worth it? If you look at the numbers alone — yes.

To Amazon or not to Amazon? It’s a decision most entrepreneurs will face, and it’s not an easy one. You have to evaluate a complicated list of potential opportunities against the myriad of challenges related to selling online.

If you’re trying to find a simple answer, then you might be tempted to purely look at the numbers. According to the State of the Amazon Seller 2023 report, 89% of Amazon sellers are profitable, and 37% reported increased profits in 2022 despite rising costs. But short term profits are not the right goal for every business. Companies focused on brand building could struggle with Amazon, which prioritizes the customer experience without highlighting the companies who offer popular products.

According to our forum’s success stories, the key is to use the Amazon platform as a step in your company’s journey. It works best as a facilitator of growth, either at the beginning stages of building a business, or after a brand has established customer affinity.

The key advice is: Do not solely rely on Amazon sales. Build your business outside of the platform as well.

The Future of Selling on Amazon: What To Expect in 2023 & Beyond

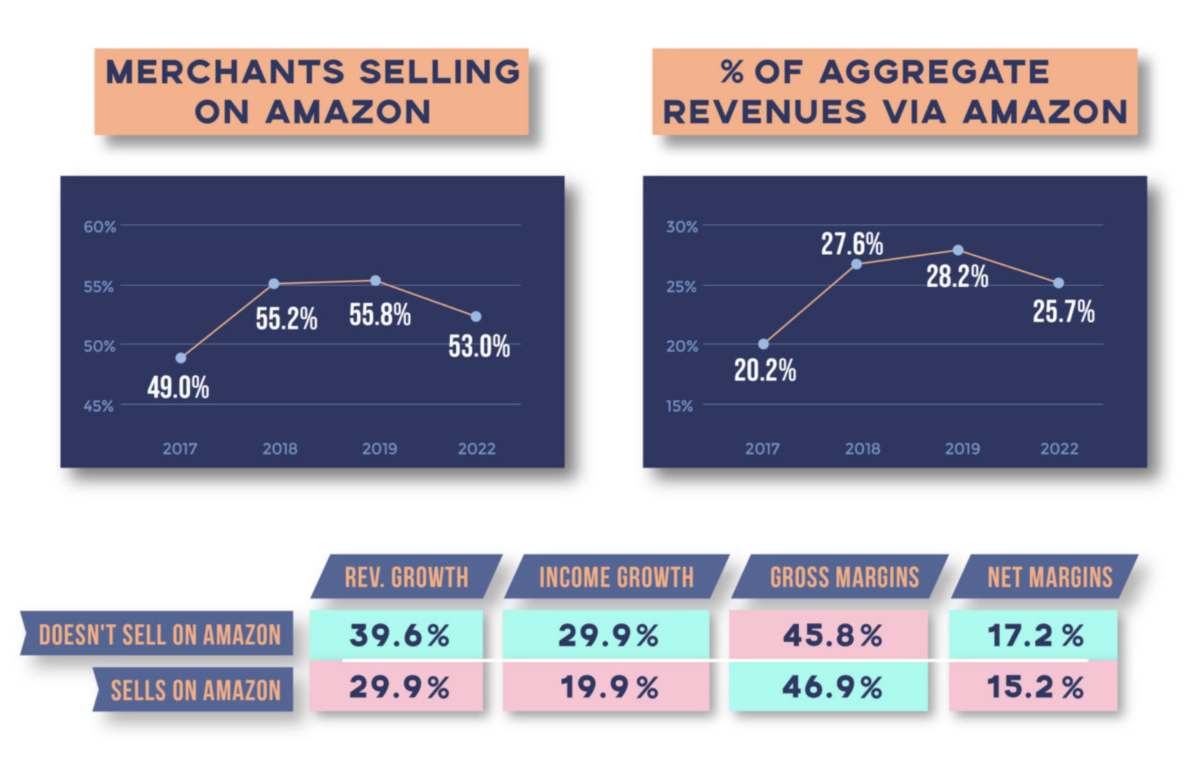

Amazon’s dominance in the eCommerce industry is undeniable. However, according to our 2022 eCommerce Trends Report, the percentage of merchants selling on Amazon has declined slightly from 55.8% to 53%, indicating a turning point to be mindful of.

While existing sellers aren’t planning to leave, off-Amazon brands are outperforming their Amazon counterparts in most metrics. This trend may signal a gradual decline in Amazon’s influence in the years to come.

But keep in mind that Amazon is a force to be reckoned with, making $514 billion in annual revenue last year. But numbers alone don’t tell the whole story.

Many brands hesitate to sell on Amazon due to associated fees, relinquishing customer relationships, and fear of cannabilizing sales or brand image.

This comprehensive guide aims to give you a holistic picture of what to consider when making this decision and offer advice from other entrepreneurs who have faced the same choice.

We’ll cover:

- Amazon Sales: Pros and Cons

- Costs to Sell on Amazon: What You Need to Know

- Mastering Amazon Sales: Insider Tips and Tricks

- Choosing Profitable Products to Sell on Amazon

- Go-To-Market Strategies for Amazon

- Considerations for Amazon Order Fulfillment

- Brands’ Success Stories: Moving On and Off the Amazon Platform

Weighing Up the Opportunity Cost + Mixed Opinions

The state of play: If you are Anti-Amazon, all the same reasons still exist, but it continues to get better. In the face of rapidly rising costs and difficult growth, anyone that has been on the fence about trying Amazon should strike now.

Founder of Petalura.com Allan Shiffrin sparked an interesting thread on EcommerceFuel’s (ECF) community forum earlier this year.

Context: Petalura, a Shopify store reselling unique products, grew to an 8-figure seller in 2022. Facing challenges with excess inventory and reduced cash flow, they considered exploring Amazon as an option to supplement their efforts in 2023 without a large upfront investment.

“Initially, the reason I’ve been considering it is due to a large volume of a particular product we offer. They are packaged with Petalura branding and are unique, with limited availability.”

The thread generated mixed opinions in our community, reflecting the ongoing debate about whether selling on Amazon is worth it.

Here’s a recap:

- One ECF member strongly suggests that Amazon is not the right platform for selling unique products as it is best suited for fast-moving commodities. It is also a high-risk channel that requires a lot of energy.

- Another ECF member points out that Amazon’s fees and commissions are quite high, which can be challenging for resellers with low margins. Additionally, there may be additional advertising costs.

- An ECF member disagrees with the previous opinions and believes that high-quality (unique) products can sell well on Amazon, especially if they have exclusive contracts with the manufacturers to represent them on the platform.

- An ECF member who states they are pro-Amazon, suggests that there are great possibilities for exclusive reselling and private label items on the platform. They suggest that it’s worth trying out a few SKUs to see what happens and note that exclusive partnerships with manufacturers and brands can be beneficial but may not always be feasible due to low margins.

- Another member warns that selling on Amazon is a long-term game that requires investment in listing building, review generation, and advertising for a long-term ROI. However, if done right, it can add significant revenue to the brand.

Based on these five opinions alone, what’s clear is there is no one-size-fits-all answer to selling on Amazon. Each opinion presents a different perspective and set of considerations.

So let’s break the decision-making process down further.

The Costs of Selling on Amazon

The answer nobody likes: it depends. The price tag for selling on Amazon depends on a few factors like what you’re selling, how you plan to fulfill orders, and which selling plan you choose. But that’s actually a good thing! It means you can mix and match options to come up with the perfect plan that aligns with your goals and budget.

Read more on Amazon’s pricing page.

For a more detailed breakdown of the required costs, recommended costs, and extra costs—highly recommend checking out Jungle Scout’s detailed costs breakdown.

They divide the costs into three categories; required, recommended, and bonus. For the sake of time, a TLDR version of this breakdown is below.

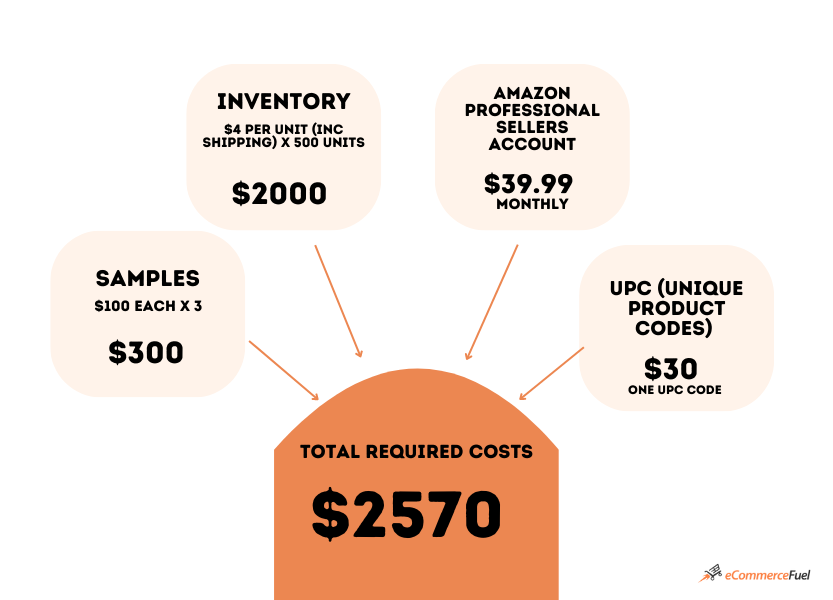

Overview: The plan is to sell a product on Amazon US as a private label using the Fulfillment by Amazon (FBA) model. The total landed cost of the item is $4, and the aim is to get a 100% Return on Investment. The product will be standard size, light enough to ship by air, and 500 units will be purchased for sale.

Note for the reader: It’s likely you already have an idea of inventory and sample costs, but for the sake of providing a full picture, we will include the extra detail.

Required costs breakdown:

- Samples: $100 each (recommended to order 3, so total cost around $300)

- Inventory: $2,000 for 500 units ($4 per unit, including shipping)

- Amazon Professional Sellers Account: $39.99 per month

- UPC: $30 for a GTIN/barcode from GS1

Consider inventory cost (the largest investment), Amazon Professional Sellers Account fee, and $30 one-time UPC code cost— all crucial factors affecting profitability.

Total required costs: $2,570

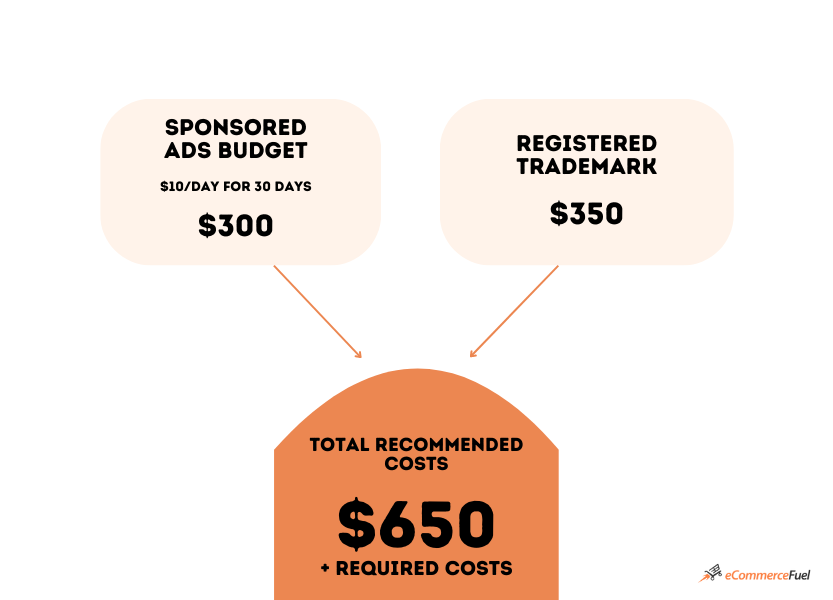

Recommended Costs Breakdown:

- Sponsored ads budget: $300 ($10/day for 30 days)

- Registered trademark: $350

Sponsored ad budget must be used with optimized product listings for effective conversion. Prior research is necessary to ensure trademark availability before creating a brand. Early trademark registration allows Amazon Brand Registry benefits.

Total recommended costs: $650 (plus required costs)

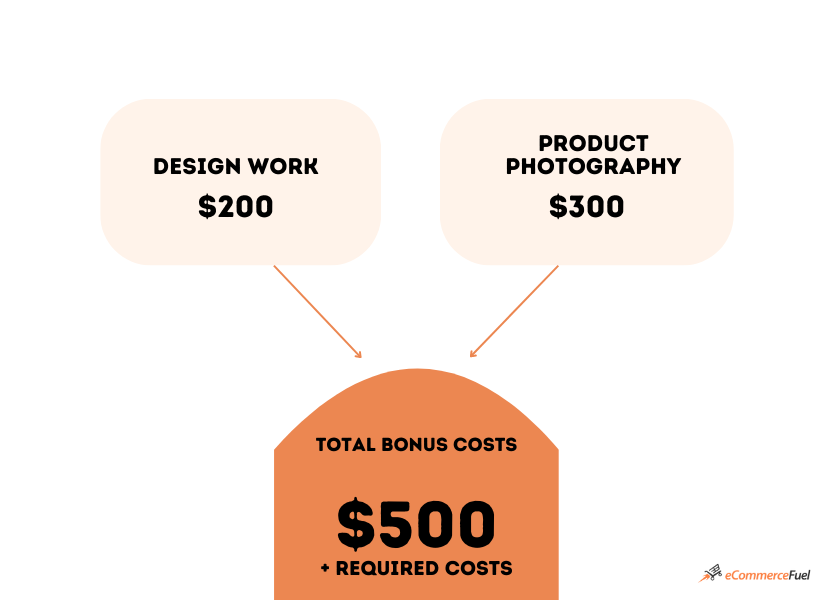

Bonus Costs Breakdown

- Design work: $200

- Product photography: $300

Success in selling on Amazon requires good design and photos. Hire a skilled designer from Upwork or Fiverr for a professional logo and packaging. Use white background and lifestyle shots for better product visibility. Closeups and comparisons can convey size and quality. Professional image editing can cost $25-$50 per image.

Total bonus costs: $500 (plus required costs)

The Grand Total: It costs between $2790 and $3,940 to start an Amazon business.

Jungle Scout’s survey reveals Amazon sellers spend $3,836 to start their businesses. For private label using Amazon FBA, costs range from $2,790 to $3,940, including mandatory, recommended ($650), and bonus costs ($500).

Takeaway: While there are costs to selling on Amazon, these costs are typically no different to what you would incur with your own Shopify store. However, you could say there are “different” costs at play here—and it really depends on what you are prepared to take on as collateral.

Mastering Amazon Sales: Insider Tips & Tricks You Need To Know Before Starting

No smoke and mirrors here— only real, actionable advice from those who have been there, done that.

Ready to make a deal with the devil? 😈

Despite the challenges, an ECF member admits it’s too hard to live without Amazon.

On top of becoming reliant on Amazon for the majority of his sales, he adds to the list of Amazon seller challenges;

- Lack of seller support: Amazon’s customer service is predominantly automated (run by bots), which means it can be challenging to speak with a human representative who can assist you with your problem.

- Problems created by bots: The bots create problems with keyword matching.

- For example, the seller who specializes in stickers has encountered issues when attempting to sell designs that feature the phrase “use hand sanitizer” on Amazon. The platform’s automated system rejects the stickers, as Amazon requires sellers to seek approval before selling hand sanitizer. Despite opening a case and explaining that the products are stickers, the seller has faced repeated rejection from Amazon.

- Slow resolutions: Amazon will lose your FBA items and require you to prove that you own the lost product.

- In this case, the seller is the manufacturer so they can only send raw material invoices. They have lost about $1,400 worth of our products, and still waiting on Amazon’s decision weeks later.

While Amazon makes it harder with minimal support and creating issues you need to solve, another ECF member said they have a team of four different experts to work across their brand and clients’ Amazon accounts.

- Brand manager— drives strategy

- Advertising specialist—knows ads inside and out

- Content creator—designs the listings (photoshop, etc.)

- Compliance specialist—uses our SOPs to fight with Seller Support and get reimbursements

On that note, advertising is absolutely required to succeed. With one search on Amazon you can see that 90% of products above-the-fold are ads. This is a pro and con. If you do advertising well you can rise above your competitors. But if you don’t, you will be putting your product discoverability and conversion rates at risk.

But the question still remains, is going down this path worth it?

Checking Search Demand: An Opportunity Hiding in Plain Sight

Did you know you could be generating demand on Amazon as a by-product of your current marketing? Interestingly, 66% of consumers start their online shopping with searches for products on Amazon.

Want to know if there’s an opportunity for your brand? Here’s how:

- Research demand on Amazon: Type in your keywords into the Amazon search bar. This will give you an idea of what people are searching for when they are looking for products similar to yours on Amazon.

- Use Merchantwords (or similar database) to get estimates of search volumes: This will provide you with common searches related to your brand and their estimated search volumes.

- Check for competitors bidding on your brand name: Watch out for any competitors who might be bidding on your brand name and taking away your potential customers.

- Use Helium10 or JungleScout to find product opportunities: Instead of focusing on the products that you have good inventory in, these tools can help you find the products that have the most opportunity for growth on Amazon.

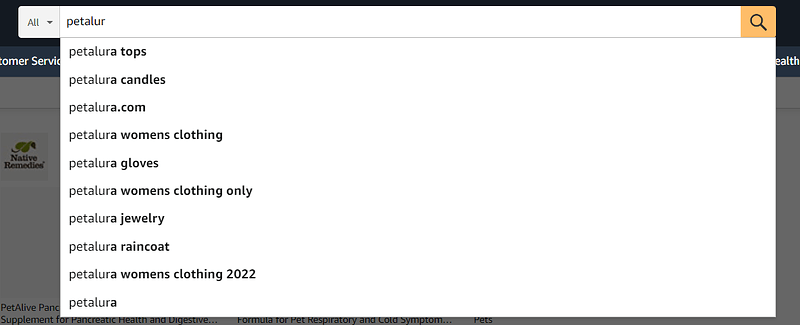

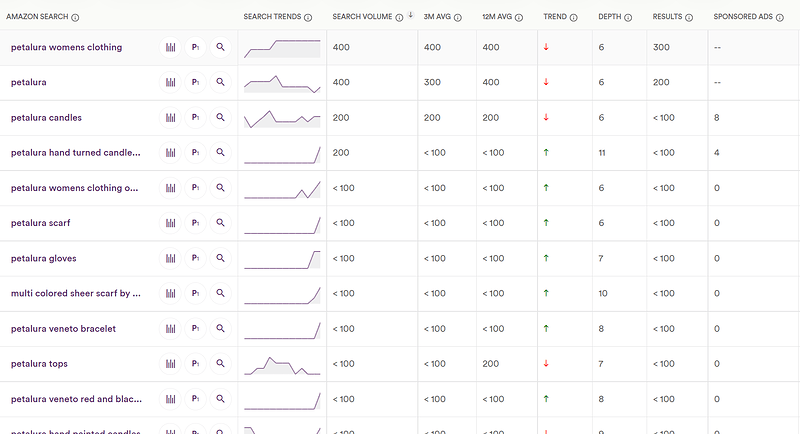

An example for Petalura:

These are the most common searches. Next, search on MerchantWords for Petalura to see common searches and their search volume.

From this initial investigation, you’ll not only be able to see if people are searching on Amazon for you, but if other brands are taking customers away from you by bidding on key phrases that contain your name.

There is an argument to say that if you don’t sell on Amazon, someone else will.

But it’s not about going all-in. The key is knowing what products to sell to fulfill the demand.

Choosing the Most Profitable Products To Sell: Branded vs. Generic 📦

Should you sell your own branded products exclusively on Amazon or generic non-branded items too? Which leads to better sales? Let’s talk about successful strategies used by other ECF members.

Selling non-exclusive SKUs

One ECF member started selling on Amazon around 11 years ago. He listed his products for sale on Amazon by matching them with existing ASINs (Amazon Standard Identification Number) of similar products already listed on Amazon. This strategy allowed him to piggyback off the existing demand and traffic for those products without having to create a unique product listing from scratch. By doing so, selling on Amazon was worth it, as he could learn how the Amazon platform worked and generate extra revenue and profit margins with minimal effort.

From his perspective, having good sales on Amazon for non-branded products is possible—but you shouldn’t make it your primary business model.

I would say out of the 10-15 or so of those products over the past 5 years, 50% of them were very successful for a short time (1 year or less), 20% were complete let-downs, and 20-30% are still selling on Amazon (US) very strong.

ECF Member

His advice for listing non-branded products: Images and titles are crucial for product listings, and setting your product apart from competitors can make a difference. But, choose your product carefully, as your account’s maturity and track record may also impact product rankings.

🔥 Hot tip: Use an Amazon listing optimization tool like Helium10 to help you improve every aspect of your product listing to maximize sales and boost your rankings.

He mentioned that despite selling generic products, they list them under their own brand name to utilize the benefits of Brand Registry and prevent others from joining the listing.

Read more: Example if you are selling non-exclusive SKUs (for existing ECF members)

Listing older products

Isaac Medeiros Founder of Mini Katana decided to sell products on Amazon after 2 years of resistance—after he found out they had 100k branded searches a month on Amazon. His strategy is listing older products and saving the best stuff for his own website.

We are only putting older products on Amazon and keeping the really good stuff on our website. So far, it’s set to do 7 figures this year with minimum effort from my team (the marketing gets done with or without Amazon).

ECF Member & Founder of Mini Katana Isaac Medeiros

Reader Note: Isaac recently said they stopped selling on Amazon as it wasn’t worth it. It was an experiment that didn’t work out well for them in the end—primarily because they do drops, and that strategy didn’t translate well on the platform.

Offer limited sizes and colors

Another ECF member said he offers a limited offering of sizes and colors on Amazon—which could be another good strategy to consider if you have a lot of SKUs.

Selling high-end business products

This ECF member recommends branding products for better control and opportunities in the sales process. However, there are still some opportunities in selling open-branded products, but it comes with potential risks and volatility.

My personal experience is that there are some opportunities in open-branded products but you should try branding where possible when possible.

ECF Member

✅ Key takeaways:

- Good sales are possible for non-branded products, but it shouldn’t be the main business model.

- Listing against existing ASINs can earn revenue and help learn the nuances of the platform.

- Images and titles are vital for non-branded product listings, along with product differentiation.

- Account maturity and track record may impact product ranking.

- Sell older products on Amazon while saving best ones for your website.

- Offering a limited range of sizes/colors on Amazon could work if you have many SKUs.

- Competitive pricing is crucial without brand differentiation to achieve a good ranking.

- The price should be at or below the top listings to have a chance at ranking.

Amazon Go-to-Market Strategies 🏌️

Two end strategies for domestic Amazon sellers: fat margin and dominate ads, or let-it-ride. The former involves raising prices, rebranding, and focusing on ads.

The latter involves shutting off ads entirely, with one big caveat: most of the people having success with this have a strong brand presence outside of Amazon, an already dominant product, or an extremely unique product that cannot be easily replicated.

Amazon Order Fulfillment Considerations 🚚

Most entrepreneurs begin selling products on Amazon by creating a private label product and using Amazon FBA, which 86% of sellers prefer. Compared to 37% who prefer FBM (Fulfillment by Merchant). And based on some ECF members experiences, FBA is better for sales.

FBA will double your sales based on what we’ve seen over the years.

ECF Member

Another ECF member exclusively uses FBM due to their large number of SKUs, although they recently launched some FBA productsm which already represent ~5% of their Amazon sales.

✅ Some key points:

- Private label sellers prefer FBA, while dropshippers and handmade artisans prefer FBM.

- FBA sellers typically spend more upfront on inventory investment.

- FBA allows for fully remote ecommerce businesses.

- FBM sellers can start selling faster than FBA sellers.

- FBM sellers usually have larger product catalogs than FBA sellers.

- 22% of FBM sellers use a combination of FBM and FBA.

But from customer scams to A-Z claims, there’s a frustrating side to selling on Amazon—no matter which fulfillment method you choose.

After selling on Amazon for many years, this seller shares his growing frustration with selling on Amazon, citing customer scams and A-Z claims as common headaches.

- In one instance, a customer returned a $250 FBA item with an older, damaged version of the product and another vendor’s sticker on it, but his claim was unsuccessful.

- In another case, USPS lost a seller-fulfilled item, prompting an A-Z claim from the buyer. Although he quickly resolved the issue by refunding and sending a new item, Amazon still marked his account negatively.

To bring you out of the rabbit hole of fulfillment experiences, remember this: Scams and claims can still occur, regardless of whether you choose FBA or FBM. It’s important to weigh the pros and cons of each option and choose the one that aligns with your goals and needs. Stay informed about potential risks and problems that may arise while selling on Amazon.

It’s Not One or the Other: Keeping Your Eggs in Multiple Baskets ⚖️

SMB sellers using a multichannel strategy for online sales are increasing and expected to continue in 2023. 61% of Amazon SMB sellers sold on at least one other channel in 2022, up from 58% in the previous year.

An ECF member considered pivoting to Amazon by shutting down his Shopify store, but received advice from forum members against it.

Context: He proposed a strategy to simplify and scale his business by shutting down his Shopify store and moving all blog content to his WP site. He planned to ship products directly to Amazon FBA, use email marketing and their WP site to increase traffic and sales on Amazon, and forward the brand URL to the Amazon store. He also planned to sell on multiple online marketplaces and create a shop page on their WP blog to link to each marketplace, believing this would eliminate the problem of customers getting information from their site but buying products from Amazon and let them outmaneuver Chinese competitors.

Instead: You want a diverse business strategy and not be too leveraged to Amazon.

Do Amazon and your Shopify store. Do Amazon to pay the bills and scale. Then use that Amazon money to build a brand off Amazon.

ECF Member

You should be testing things. Test sending inventory into FBA, test seller fulfilled. Test buy with Prime. Test it all and see what is the cost-benefit.

ECF Member

But others have chosen to stay off.

I have chosen to stay off Amazon for these reasons: I want to own my customer data, I want control over the customer experience, and returns and reviews are in my control.

ECF Member

Success Stories: Journeys Into And/Or Out Of Amazon 🚀

Here are some brands that have experienced success by either entering or leaving the Amazon platform.

Tarriss Travel Gear—Moved away from Amazon

Tarriss Travel Gear started on Amazon in 2014 with a $6,000 investment and a single private label product. In four years, they reached seven figures, with 90% of sales coming from Amazon. But in 2018, they decided to diversify and move away from Amazon.

We’ve finally kicked the Amazon habit like we’ve been trying to do for years now. Amazon accounted for less than 20% of our revenue. Today, it accounts for 0%. Just this morning we closed a deal to sell Tarriss Travel Gear completing our journey into and out of Amazon.

TouchUpDirect—Adjusted their Amazon reliance

TouchUpDirect initially focused on Amazon, but they later diversified their sales channels. They currently have a 75/25 split between their website and Amazon, with a strategy in place to grow their Amazon business while protecting their eCommerce business, such as only offering their top colors on Amazon. They’ve had success with FBM and plan to replace all FBM sales with FBA in the future.

Animalhouse Fitness—Branching Out to Amazon & Keeping Shopify Store

ECF member Paul Jackson, founder of Animalhouse Fitness, exclusively sold on Shopify for two years. Recently, they decided to launch on Amazon to reach new customers without affecting their DTC sales. Their main product MonkeyFeet already has some search volume and copycat versions on the eCommerce platform—so their ideal goal is to rise above these competitors. However, they are still in the process of launching on Amazon and haven’t evaluated its worthiness yet.

Paul shared some insight into what he learned recently from eCommerceFuel Live:

- Doing FBA instead of just FBM using our existing 3PL. Apparently, FBA converts 2-4x as well as FBM, which is hard to pass up!

- Running some basic PPC ads in order to capture branded traffic. We haven’t dove into this quite yet, but this is on the agenda.

If you are pondering whether to bite the Amazon bullet, AnimalHouse Fitness’ journey is one to watch!

Final Thoughts: Is Selling On Amazon Worth It?

There’s no single definitive answer to whether selling on Amazon is worth it. It’s natural to feel protective of your brand, so instead of going all-in, try dipping your toes with one or two products to see how it goes. You never know until you try.

Want more? Access Nearly 3,000 Amazon-Specific Discussions Inside ECF

If you want more resources and advice from other entrepreneurs in your shoes, join our community of 7-8-figure brand online store owners. All our members are vetted practitioners—not vendors or beginners—ensuring everyone has a deep, meaningful eCommerce experience to share. Apply today!