Alibaba vs. Amazon: An In-Depth Comparison of Two eCommerce Giants

Everyone likes a good showdown. With Alibaba’s recent IPO, people are eager to pit the two eCommerce juggernauts against each other to create an Alibaba vs. Amazon faceoff.

But Alibaba is widely misunderstood. And despite being an enormous eCommerce peer, it’s extremely different from Amazon. Are the two really destined to be arch enemies or is it all just exaggerated drama?

In this post, I’ll be comparing Alibaba vs Amazon and dive deep into the nitty gritty of both companies: what makes them tick, how they make money, how they’re different and what they mean for the future of eCommerce.

Note for Financial Geeks Like Myself: Most of the data below has been taken from Alibaba’s recent IPO prospectus and Amazon’s 2013 annual report. Alibaba’s annual figures represent the calendar year prior to their March 31st fiscal year ends.

History

Most eCommerceFuel readers will be familiar with Amazon’s history. In the mid-90s, Jeff Bezos founded Amazon which began by focusing solely on selling books. They’ve since grown into the behemoth they are today, and are now the largest online retailer in North America.

Alibaba was founded in China by Jack Ma in 1999. Ma didn’t have Bezos’ technology or business background. An English teacher, he had failed at his previous two business ventures. But despite those setbacks, he raised money from family and friends to launch Alibaba.com – a B2B portal for connecting Western businesses and Chinese manufactureres.

Since then, the company has grown to be the largest eCommerce company in the world (measured by both gross sales and company value) and recently went public in the largest IPO in history.

Philosophy

As we’ll get into, there is much that sets these two companies apart. But the starkest contrast can be seen in the philosophy each company has.

Jeff Bezos’ long standing goal is to build the world’s most customer centric company. And it’s hard to argue with his progress. Despite their size, Amazon’s customer service – in terms of pricing, delivery and customer support – is impressive.

Amazon is obsessed with the customer and getting them the best possible price – at almost any cost. They’re notorious for alienating suppliers, content partners and publishers in their pursuit of this goal.

You can see this in their ongoing fights with publishers for higher royalties and by undercutting suppliers by ignoring pricing guidelines as alleged in the book The Everything Store. Even members of the eCommerceFuel Private Forum have reported being squeezed out of a market by Amazon and/or experiencing aggressive tactics.

Jack Ma and Alibaba have a different focus. The following quote is taken from their recent IPO prospectus:

“Our proposition is simple: we want to help small businesses grow by solving their problems through Internet technology. We fight for the little guy. Since our founding in 1999, we have helped millions of small businesses to achieve a brighter future.”

“…we want to help small businesses grow by solving their problems through Internet technology. We fight for the little guy.” -Jack Ma of Alibaba

Alibaba’s goal to help small businesses stands in stark contrast to Amazon, who is often (fairly or otherwise) criticized for making it harder for small businesses to compete and stay relevant online.

So is there ANY common ground between the two? Actually, yes. Both relegate shareholder interests to the bottom of the totem pole.

Jack Ma has repeatedly said that Alibaba’s priorities are their employees, their customers and then the shareholder, in that order. And Jeff Bezos is notorious on Wall Street for continually investing in the future of his company at the expense of providing short term returns / profits to shareholders.

Business Models

Alibaba has traditionally been best known in the United States for Alibaba.com – their B2B portal that connects Chinese factories and businesses. But that’s not why you’ve been hearing so much about them recently. Where they REALLY make their money is in facilitating eCommerce within China.

Alibaba’s Taobao division is where they make the vast majority of their money, is responsible for more than 80% of Alibaba’s sales and consists of two main properties:

The Taobao Marketplace is similar to eBay, and allows consumers and small businesses to list merchandise for sale. The other major platform, Taobao Mall, is more akin to Amazon. It’s a B2C platform that allows larger businesses and brands to sell direct to consumers.

Sales on the Taobao marketplaces make up more than 80% of all online purchases in China. Let me repeat that. 80% of all online purchase in China. That’s mind boggling.

To say they have a stranglehold on eCommerce in China is an understatement. Amazon’s share of the U.S. market is nowhere near those levels.

Alibaba accounts for more than 80% of all online purchases in China.

What’s important to note is that Alibaba’s platforms merely facilitate the transactions. They manage the marketplace and charge a small commission, but don’t hold – or sell – any merchandise themselves.

Amazon, by comparison, plays in both markets. On Amazon.com, you’ll find thousands of products you can by directly from 3rd party businesses. But Amazon is also in the business of stocking items and selling products directly to consumers. In many instances, they’re competing directly with the same merchants who are using their platform to sell.

Both companies have other business arms. Each has a cloud computing division (although Amazon’s is much bigger), both are involved with media creation and Alibaba even owns a stake in a professional Chinese soccer team!

But the marketplaces where they sell products are the bread-and-butter of each one’s business.

Geographic Focus

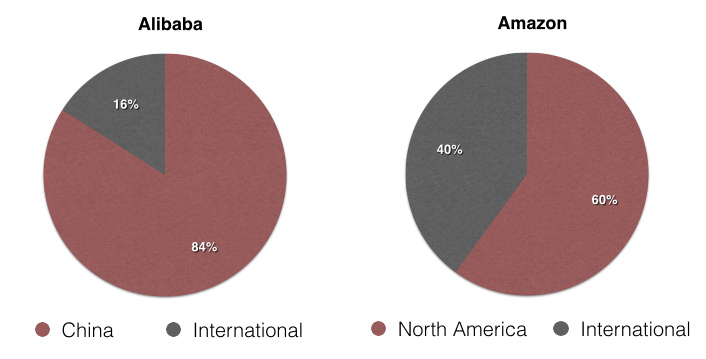

As I’ve mentioned already, Alibaba’s primary money making operations are from operations within China. So the chart below won’t be a surprise.

But what’s interesting is how much of Amazon’s business comes from outside North America – a whopping 40%!

There’s been lots of talk about how Amazon should fear the entrance of Alibaba into the U.S. market – and it will definitely be interesting to see how that plays out. But who has the better track record of expanding outside their home market? It’s definitely Amazon.

Who Sells More Stuff?

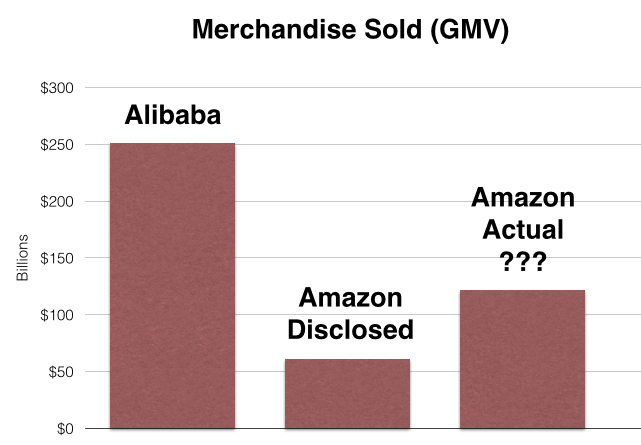

In 2013, Alibaba reported GMV (gross merchandise volume) of approximately $250 billion. That means more than $250 billion worth of transactions were made / facilitated via their platforms.

Amazon, by contrast had 2013 product revenues of approximately of $61 billion – significantly less than Alibaba. But this number is misleading, because Amazon doesn’t count any of the sales made by 3rd party merchants in this number. They only count sales where they were the business directly selling to the consumer.

So making the comparison is difficult because the two firms don’t disclose the same metrics (GMV). In a recent article, Ben Evans speculated that Amazon’s actual GMV (the amount of total stuff that gets sold on their site) could be in the range of 2x what they list as product revenue.

So who’s bigger from a product sales standpoint? It’s probably a safe bet to say Alibaba is larger but it’s impossible to know for sure.

Service & Fee Revenues

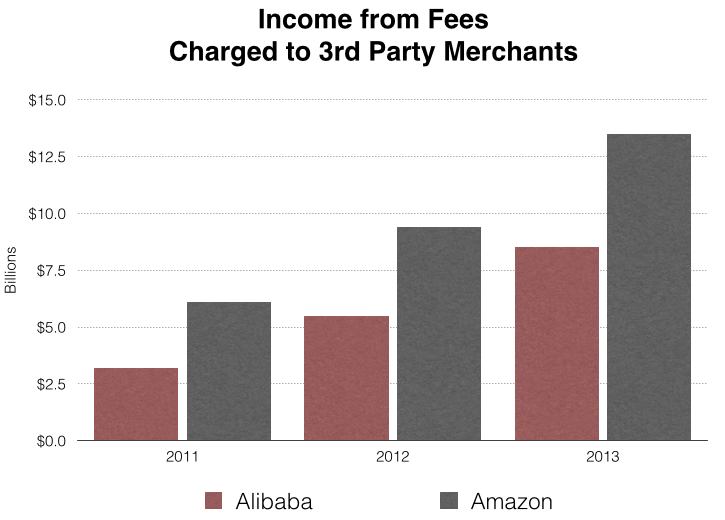

It’s important to understand that GMV – the value of all the goods sold / orders places on a platform – isn’t the same as what the company actually collects in revenues or profits.

For example, assume someone places a $100 order on one of Alibaba’s sites for a camera. The $100 will count toward the GMV reported, but Alibaba will only receive a tiny fraction of that as a listing / transaction fee – say $2. That tiny fee is ultimately what’s important, because it’s what Alibaba gets to keep as profit.

When you compare the amount of money that Alibaba and Amazon generate (and get to keep) from service fees, a different picture in terms of size emerges.

Despite having a marketplace that moves significantly more goods, Alibaba doesn’t collect nearly as much in fees / sales commission as Amazon.

(Note: There are some fees for other services included in this chart, like cloud based computing offerings, but it’s predominantly made up of fees charged to 3rd party sellers).

Profitability

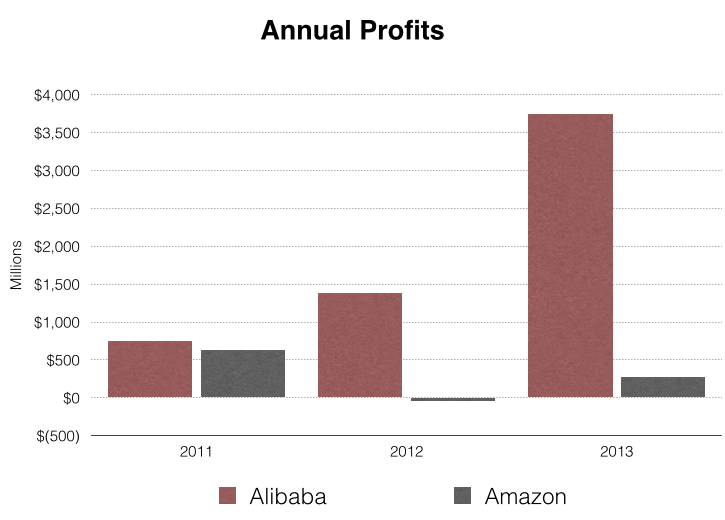

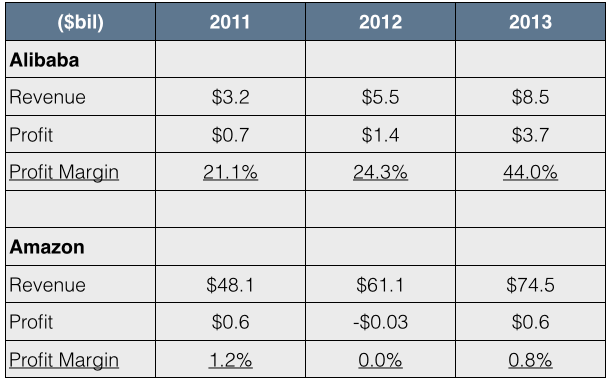

Alibaba sells more stuff. Amazon generates significantly higher fee revenues. So who ends up actually making more money?

Surprisingly, Alibaba. By a long shot.

In 2013, Alibaba made more than 10x as much money as Amazon. While Alibaba’s profits have grown consistently in the past few years, Amazon’s have languished. Amazon even lost money in 2012.

Why such a massive difference?

Unlike Alibaba, Amazon actually stocks their own products. And building out warehouses in their attempt to take over the eCommerce world is no small (or affordable) feat.

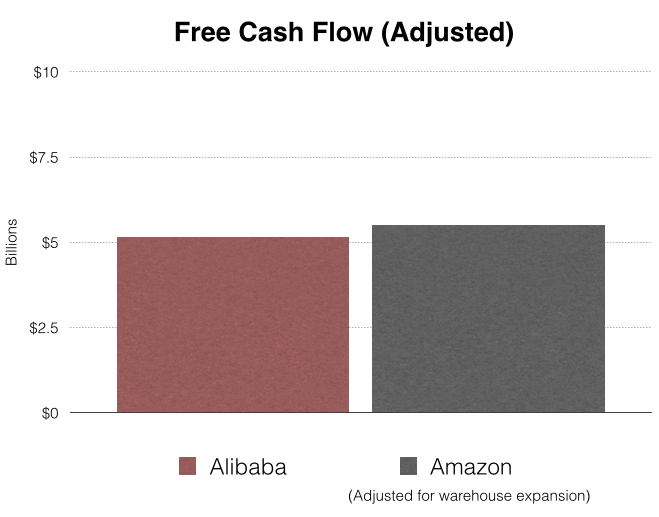

To help normalize this a bit, let’s look to a different metric: free cash flow. Without getting too technical, free cash flow tells you how much cash a company is generating and removes the noise introduced by accounting techniques and other one-time events. In short, it can offer a clearer picture of a business’ health.

Normally, the costs involved with building new warehouses (called capital expenditures) would be taken out of free cash flow. But to normalize our comparison given Amazon’s wild building spree, I’ve added these warehouse expansion costs back in.

Amazon has an ever-so-slight edge, but the two companies both generated approximately $5 billion in free cash flow in 2013.

Why Such a Difference?

As you can see in the chart below, Amazon had a 0.8% profit margin in 2013. Alibaba, by contrast, had a 44% profit margin in 2013 – more than 50x higher.

So what explains this monumental difference? In a phrase, “warehouses vs. software”.

What explains this monumental difference? In a phrase, “warehouses vs. software”.

Alibaba doesn’t sell products themselves. Instead, they simply offer a web platform that facilitates the exchange of good. They’re the world’s largest eCommerce company, but they’re actually much more like a software company than a retailer.

Amazon, by contrast, is in the business of selling directly to consumers – and has to deal with all of the logistically complex and expensive physical aspects that go along with it. Namely, building out a vast warehouse network.

It’s this difference that explains why Alibaba has been able to grow so quickly and remain highly profitable, while Amazon has had to sacrifice profits for two decades to get where they are today.

Bottom line? Software tends to scale better than warehouses do.

The Future

Are these two powerhouses destined to meet in a spectacular pay-per-view battle for eCommerce supremacy? As fun as that would be to watch, it’s unlikely in the near future.

Alibaba has a stranglehold on the Chinese market and Amazon is the undisputed U.S. leader. They both have such a massive head start – and an intimate understanding of their market and models – that it’d be extremely difficult for one to knock the other from their perch.

But Alibaba’s Jack Ma has stated that they have plans to invest seriously in the U.S. And Amazon isn’t known for shying away from a fight, even if it proves to be costly. So what will happen?

There have been talks of Alibaba purchasing a company like eBay or Etsy, which would make sense given their platform approach in China and focus on smaller businesses. But I think a potentially even bigger opportunity for Alibaba would be to help Western merchants reach the massive – and still largely untapped pool – of Chinese consumers.

Imagine if smaller independent U.S. merchants could easily sell and ship their high-end products to consumers in China. Currently, there are a number of issues that make that difficult (logistics, language, culture issues) but Alibaba could create a platform that addressed those problems.

They’ve already proved the model by successfully connecting Chinese manufacturers and western businesses with Alibaba.com. As China’s middle class grows and matures, why not flip that model on its head?

It will be especially interesting to see how Amazon addresses Alibaba’s rise, and what their next move will be.

Given Alibaba’s more profitable and scalable model – and their momentum – I think they have the advantage for any head-to-head battles in new markets. But Amazon does have a better track record of expanding internationally and, like I said earlier, has never been one to shy away from a fight.

Whatever happens, it will undoubtedly be exciting to watch.

What are your thoughts on Alibaba vs Amazon? Leave a comment and let us know what you think.

Related Posts

The Dangers of Selling on Amazon

How to Get Reviews on Amazon

The Top Amazon Seller Mistakes (And How to Avoid Them)

38 Comments

I think Alibaba could immediately have a huge impact in America (and elsewhere) simply by highlighting those manufacturers in their vast pool who will drop ship goods. As it is, the majority of them have very large minimum orders, which makes it difficult for small businesses. The easiest way of doing that, I think, would be for Alibaba to facilitate a sort of escrow account that small businesses would put their money into that would satisfy the minimum order demands of manufacturers but still allow them to ship goods one at a time to consumers. Money would be withdrawn from that escrow account per order and the small business owner would periodically replenish the money in the account when it started to get low.

Hi Scott,

Your idea is most interesting . Can you please go in a little more detail on the Escrow account route as a safe catalyst between small manufacturers and large buyers through eCommerce ?

I mean can you please explain the process step-wise from both ends ? ( Small Manufacture’s and Bulk Buyers) ?

Regards

As a related example, I’ll use a jewelry website that I used to own. I found a supplier in China that I trusted after placing a few test orders (they don’t have minimums on sample orders) and, because their minimum order amount was $500, I sent them $500 via Western Union (actually, I paid $514 including the Western Union fee) to set up a draw account. Because I had set up that minimum order requirement, they had no problem dropshipping individual orders to my customers (subtracting the wholesale price plus shipping from my draw account). When that $500 was nearing depletion, I would send them another $500. Soon, the business was really growing and I was sending $2,000 twice a month.

Rather than having to rely on the instincts and trust of individual website owners, Alibaba could set up escrow (or draw) accounts that website owners would deposit money into, acting as a buffer between the website and the foreign manufacturer. When you place an order for an individual item, that item would be dropshipped to the customer from the manufacturermand the money would be withdrawn by the manufacturer from the escrow account that Alibaba is holding. This keeps the company owning the website safe, knowing that Alibaba has their money, which they could get back anytime if things sour with the manufacturer. The manufacturer is satisfied because their IS the amount needed to satisfy their minimum order requirements and, provided they deliver as they are supposed to, they have no risk of not ultimately getting their money, even if it is one order at a time. If the individual website goes out of business, they do not get their money back (they promised the minimum amount to the manufacturer, after all).

Make sense?

Incidentally, I have found MANY foreign suppliers with minimum order amounts who have no problem with dropshipping as long as a draw account is set up with them. My “twist” on that is to have Alibaba holding the money instead of the manufacturer (I got burned once by a manufacturer in China who went out of business and what was left of my deposit disappeared along with the manufacturer).

Obviously, if Alibaba had been holding onto my money, when the manufacturer went out of business I could have gotten my money back. From Alibaba’s perspective, they get to “play” with that escrow money the whole time, investing it as they choose, just like any bank would, so their is definitely an incentive on their part to play “middle man” here.

Hey Scott,

Thanks a lot ! Sure that makes a lot of sense , indeed !! Just a few things for more for clarity on the process at my end …

1. Does the manufacturer have to submit the proof of dispatch/ delivery to the web portal , in this case say Alibaba for their payment to get released ?

2. What are the ways any Buyer / Order placer trust any “relatively new / unknown website” escrow account ? As we know Alibaba is a big brand . Buyers will not think too much before crediting the escrow of Alibaba with their order money. Hope you are getting what I am trying to say ?

3 So the model as you suggest is as follows: (Please correct me if I am wrong ) : Scott places an order on Alibaba on a Chinese manufacturer and places $500 (minimum order value) in the escrow account -> The Chinese manufacturer is informed by Alibaba of the order and the money they have received in the escrow account -> The Chinese manufacturer manufactures and ships goods worth say $500 (say 10 pieces , $ 50 each) to buyers A through J across the world at the listed price and on their website -> The proceeds of these A through J pieces go to Scott ?? OR Does the Chinese manufacturer send the 10 pieces to Scott ?

In both cases what happens if the goods are not up to standard or agreed standards ? Does Alibaba’s escrow protect the purchaser and his money from such an unfortunate happening ?

Hope I am able to articulate both my apprehensions i.e one on the process flow of the transaction and the other on the protection of the buyer against differences in order standards and whats finally delivered ?

Cheers

1) If you’ve ever done business with China, you will know that they don’t even make a product until they have been paid to make it, so no, requiring proof of shipment before they get paid would probably not work. You have to realize that there is always going to be a minimal degree of risk, just as there is with any place that you do business with. Very few manufacturers on any continent will ship the goods first and collect their money later (just like you wouldn’t ship things to a customer before they paid you). Of course, it they never shipped the goods, they would be removed from Alibaba as a reliable manufacturer, so they’d be cutting their own throat by doing that.

2. In ANY dropshipping business, unless you are doing business with a very highly respected manufacturer (think big brand names like Nike, Ford Motor company, Wilson Sporting Goods, etc.), you should always order samples of their merchandise so that you can check out the quality and also see how long it takes from order to delivery. Once you know the merchandise/manufacturer is sending good products in a timely manner, the rest is really trusting your gut and taking a chance by sending the manufacturer money to set up a draw account. This is a risk, but if Alibaba served as a “middle man,” the majority of that risk would be gone.

3). I think the best way to describe this is to show an example:

Manufacturer ABC Widgets in Shenzhen China has a minimum order quantity of $500. I set up an escrow account on Alibaba for $750 (the extra money is to cover shipping to customers). Then, orders start coming in …

– December 20, 2014 – order for $75 (my cost worth of products) + $25 shipping to customer. Manufacturer takes $100 from the escrow account, ships goods to customer and provides me with tracking number for shipment.

– December 30, 2014 – order for $150 (my cost) + $50 shipping = $200. Manufacturer takes $200 from the escrow account, ships products to customer and provides me with the tracking number.

– January 4, 2015 – order for $50 (my cost) + $20 shipping = $70. Manufacturer takes $90 from the escrow account, ships products to customer and provides me with the tracking number.

There is now $410 left in the escrow account and we continue in this manner until I get down to about $100 in the account. At that point, I add more money to the escrow account. I can add whatever amount I want – even less than the minimum – because I have already met the manufacturer’s minimum requirement.

Alibaba is not in charge of making sure the goods are up to standard. That is your responsibility and is part of the reason you should have ordered samples. In the case where a customer receives a damaged or defective product, it is no different than it is when you are working with any supplier. The customer ships the goods back to the manufacturer (in this case, a manufacturer in Shenzhen China) and the item is either replaced or refunded in full, including shipping.

Now, if Alibaba wants to take on the responsibility for making sure goods are up to standard and act as the arbitrator, great. I wouldn’t expect them to agree to doing that unless they were getting a cut of the sale, though. At the very minimum, I think Alibaba should have a rating system from real businesses doing dropship business with the manufacturer so that prospective businesses can read about other business’ experiences with the manufacturer before taking the plunge, themselves.

Hi Scott ,

First of all let me apologise for reverting so late to your mail.

Now things are crystal clear !

Thanks a lot for taking the time and effort to explain matter so very nicely to me.

I must say you have great potential in the teaching line . And I mean that seriously !

Before we started interacting , I had seen it work outstandingly well on a famous Freelance jobwork site website http://www.elance.com . Its a website / e job work and software makers and buyers . Like you have suggested , it also has the star rating system by the user and the area where a user can give his comments and reviews on the services received for all to see . It also gives an overall picture of the freelancer in terms of skill base /projects done / no of hours etc has .

Its also a bidding site for freelances for Job Postings , in a way !

But on a product basis your Chinese example is very comprehensive .

I am trying out an e-commerce portal and I definitely plan to try out the escrow account idea of yours .

But as we both understand , that any buyer or manufacturer would trust a well know site like Alibaba / Elance etc . But if a new portal gives the facility , do you think there will be takers for depositing money in to an escrow account of the portal ?

I shall await your views on the matter .

Best Regards

[…] Alibaba vs. Amazon: An In-Depth Comparison of Two eCommerce Giants […]

[…] Alibaba vs. Amazon: An In-Depth Comparison of Two eCommerce Giants […]

Why no mention of “11 Main”, Alibaba’s new US shopping site, as part of their future US strategy?

Nice catch, Steve – you’re right. Definitely should have mentioned it! Hopefully will cover that in a future piece.

Hi Andrew! Thanks for all the great info on eCom – you’re the best!

I’ve read everything you have and I’ve been meaning to ask you for a while, as this is one aspect I still don’t get: if there are a lot of established apparel stores (Kohls, Nordstrom, etc.) ranking their categories on site for a particular generic clothing item, say, Underwear or something, but there’s no store that’s focused specifically on that single item (Underwear in this case), like mensunderwearstore.com, for example.

Is it a smart idea to open an eCom store and focus specifically on that one clothing item even with all those established brands carrying it among the thousands of other products they have?

As someone who has buying directly from Alibaba for a few years, I can tell you that consumers can buy direct from China with small orders of 1 or more for less cost than they can buy from nearly all American businesses. If, they’re willing to wait an extra week or maybe two for their bargains. Chinese businesses set up simple companies which buy bulk orders then parcel them out to American shoppers looking for bargains. Single items sell at a much higher price than bulk orders, obviously, but the Chinese stand to make huge gains by cutting out American middle men counterparts. Not only do they sell their goods direct from Alibaba, and Alibaba Express, but also on Ebay and Amazon. As these Chinese operations begin to sell more confidently & directly to American consumers, their focus will continue to shift away from B2B to direct marketing. Bezos knows formerly cheap slave-labor goods from China are becoming more expensive, which is one reason why he has invested heavily in India. The next Alibaba-type competitor (maybe Flipkart) will likely come from India.

Jake, I have to absolutely agree with you. Is your experience mostly with Alibaba or Alibaba Express, as a consumer or a business?

Alibaba will have a new US stratergy to compete Amazon. Great growth from Alibaba.

I listened to that podcast with the friendly wager on the stock price. The back and forth pushed me into invest in Alibaba. I bought the Jan ’16 Calls at $150 strike and quickly am up 20%! Little did I know, investment ideas would come from Andrew. Thanks bud!

Glad to hear, James! But please don’t count on me for stock tips – my track record is pretty lousy. 😉

[…] Alibaba vs. Amazon: Andrew at eCommerceFuel takes an in-depth look at Alibaba and Amazon examining the respective e-commerce giants history, philosophy, business models, services, fees and revenue. Continue reading… […]

hi andrew is there a user manual book on how to use alibaba effectively & efficiently, can you recommend me their best manual book? pls message me on my email, pls also include amazon too

Alfonso, did you ever get information you were looking for regarding a user manual or book on how to use Alibaba effectively? I too would be interested if you have come across this info.

Thank you

[…] Alibaba vs. Amazon: An In-Depth Comparison of Two eCommerce Giants […]

That’s an awesome comparison. Both Alibaba and Amazon are the undisputed kings in their countries. But now Alibaba is expanding its reach internationally. But I’d still say Amazon enjoys its incredible reputation all over the Globe!!

[…] Comparison between Alibaba and Amazon, eBay (the major difference is on Alibaba and Amazon) […]

[…] https://www.ecommercefuel.com/alibaba-vs-amazon/ […]

[…] E-commerce provides a broad platform for enterprises to carry out a variety of business activities. Small and medium-sized foreign trade enterprises can use their own e-commerce platform to show the various image, advertising and selling products, improving enterprise well-knowingness, expanding the awareness in the international market, to enhance their own competitiveness. “…we want to help small businesses grow by solving their problems through Internet technology. We fight for the little guy.” -Jack Ma of Alibaba (Alibaba vs. Amazon: An In-Depth Comparison of Two ecommerce Giants) […]

[…] hand, Alibaba believes in empowering small businesses. Excerpt from Alibaba’s IPO prospectus read as, “Our proposition is simple: we want to help small businesses grow by solving their problems […]

[…] Jeff Bezos has always focused on customer and Amazon has always been very customer centric. Despite the growth and size of the company, their customer service in terms of pricing, delivery […]

wow !!! never thought that Alibaba has more profit then Amazon !!!

[…] Ecommercefuel.com. Alibaba vs. Amazon: An In-Depth Comparison of Two eCommerce Giants. https://www.ecommercefuel.com/alibaba-vs-amazon/ […]

Amazon is on the world domination right now, they’ve recently launched in India and it is being advertised very heavily on the local channels and I think it is a household name that is very tough to compete.

Really? Alibaba can compare to Amazon?

Actually people are not using Alibaba to source products and sell on Amazon so one can see where each platform stands right now but with that being said Alibaba do have a strong customer base and a lot of Americans have started using it now.

Amazon is on the world domination right now and they have many brand in big country right now even in China and India but with the rapid grow of Alibaba, he will have best strategy to compete with Amazon because right now Technology and Business idea of Chinese is awsome.

[…] of Alibaba, Jack Ma once said, “Our proposition is simple: we want to help small businesses grow by solving their problems […]

Found a free shopping comparison site for mobile. They compare Amazon and eBay marketplaces around the world, so we know where to buy the cheapest in the world.

http://world-buy.net/

Hi Scott,

I never thought that Alibaba has more profit then Amazon.

I think Alibaba will grow up soon, but still can’t compare to Amazon!

When making your own products, you can closely control the quality of your products ensuring they live up to your expectations as well as your customers.