eCommerce Trends Report

Last Updated July 14, 2022

I’m excited to announce the 2022 eCommerceFuel Trends Report! We’ve crunched data from over 600 stores to unpack what’s happening in eCommerce and find insights to grow your business.

Here’s this year’s four biggest takeaways:

- ROAS Is Wildly Overrated for Success

- We’ve Hit Peak Amazon

- You Need to Raise Your Prices (Again)

- Manufacturing + Storytelling Crushes All Other Models

Want all the juicy details behind the takeaways? Read on.

First, a huge thank you to all our partners. They were instrumental in spreading the word about this study, contributing insights and more. Thank you Quietlight, A2X, Fulfil.io, eComm Crew, Intelligems, Postscript, Post Pilot, Zipify Apps and Common Thread Collective.

And thank you to all the brands who answered our litany of in-depth questions. This report wouldn’t be possible without you!

(Note: eCommerceFuel has been sponsored by and/or invested in some of the brands above. We think they’re awesome but in the sake of full transparency wanted to let you know.)

This year’s data set is the largest (600 stores representing over $4B in revenues) and the most experienced ($7.1M average size) we’ve ever had the opportunity to work with. It’s pretty cool to be able to dive into a unique data set like this.

Like previous years, the stores participating are predominantly U.S.-based. For the first time ever we asked about a brand’s competitive advantage. The results were well diversified with one exception: almost no one reported ‘Great at Advertising’ as their competitive advantage, which surprised me.

2020 brought COVID and along with it a torrent in online sales. Few were excited about the pandemic but the surge of online sales was a massive boon for many in our industry, even if it was a struggle to keep up.

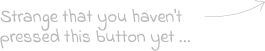

Then came 2021 and an almost complete reversal of those tailwinds: hiring was impossible, prices surged, Apple maimed Facebook traffic’s effectiveness and supply chain issue were everywhere.

So I was a little surprised when only about 1/3 of participants cited 2021 as their worse year in business, ever. I’m a betting man and I would have put money on something closer to 50%.

The most common question from new eCommerceFuel Community members is “How do I recover from the blow to Facebook’s effectiveness?”

Thankfully some of these challenges are moderating. Container prices are coming down, port backlogs are decreasing and the hiring market is getting slightly less difficult.

iOS impacts are still being felt by a large number of merchants whose business models are still reeling. The most common question from new eCommerceFuel Community members is “How do I recover from the blow to Facebook’s effectiveness?”

Complying with the absurd sales tax requirements in the U.S. continues to be a major headache with the average $7M brand in our study spending $9K per year in compliance costs. Thankfully Congress is beginning to acknowledge the issue and explore solutions.

The Senate Finance Committee recently had an official hearing in June dedicated to the issue. Big thanks to eCommerceFuel members Michelle Huie from VimVigr.com for testifying and to Hilary Halstead Scott from HalsteadBead.com for her sales tax reform efforts over the years.

Pricing is one of the most powerful levers a business has: changes can be made quickly and results flow immediately to the bottom line.

One caveat: it is absolutely terrifying to raise prices. Visions of evaporating revenue and angry, pitchfork wielding customers often keep merchants from experimenting with pricing.

Great news for those who can relate to the nightmares: a whopping 86% of brands reported a positive experience when raising prices with revenues either increasing or staying the same. In the latter case you have the same revenue with higher margin and fewer customers, a win despite flat sales.

Suppliers increased prices 15% on average compared to an 11% increase by merchants, a deficit we’ll see impact average net margins later.

Pricing experts, Intelligems, conducts hundreds of pricing test for Shopify brands each year so we checked in with them to get a sense of how customers are responding to increases.

80% of brands found that adding in a free shipping threshold or raising their free shipping minimums was a profit-accretive decision.

They reported customers being more price sensitive this year with sharper revenue drops when price hikes hit. Their sensitivity, however, didn’t seem to extend to increased shipping fees:

From Drew Marconi, Intelligems co-founder:

“Customers are less price sensitive [this year] when it comes to shipping rates with fewer baulking at ponying up. 80% of brands found that adding in a free shipping threshold or raising their free shipping minimums was a profit-accretive decision.”

Takeaway: Test raising your prices and experiment with your free shipping rules to maximize profits.

My favorite part of the study is learning from the commonalities among successful brands. What’s truly important and what’s window dressing?

To answer this question we looked at a few different groups: fast growing and growing AND profitable companies.

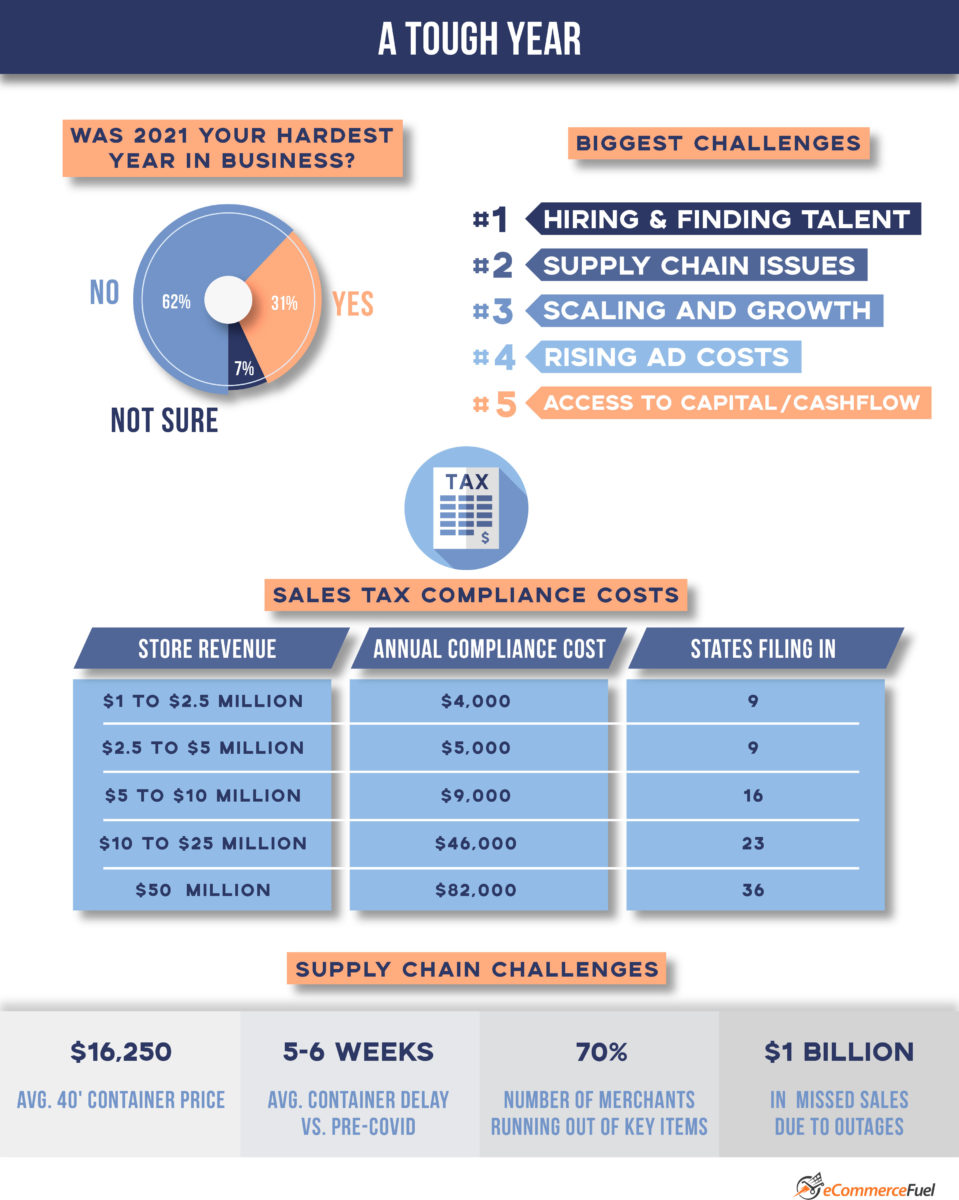

The number one takeaway? ROAS doesn’t determine your level of eCommerce success.

Shockingly, the difference in ROAS between top and bottom performing stores was negligible. Given it’s a metric many brands obsess over it’s surprising to see how little impact it had.

Here’s what did drive successful outcomes: a brand’s business model and their operational efficiency.

Successful stores were 6x more likely to cite “Branding and Storytelling” as their competitive advantage and 77% more likely to manufacture their own product, a truly potent combination.

Successful stores were 6x more likely to cite “Branding and Storytelling” as their competitive advantage

Operational efficiency had just as large of an impact. Top brands in the growing and profitable group had half as many people on their payroll, were 25% more likely to outsource warehouse operations and 25% less reliant on paid traffic.

Taylor Holiday from Common Thread Collective tweeted something that illustrates the point perfectly. He said: “You don’t have a ROAS problem. You have a margin problem.”

For many brands, he’s spot on. You can just as easily replace ‘margin problem’ with ‘too many employees problem’, ‘business model problem’ or ‘paid traffic addiction problem’.

Takeaway: Obsess less over your ROAS and more about your operations and business model.

Merchants are more reliant than ever on paid traffic. Since 2019, they’re 56% more likely to report paid traffic as their top source of visitors.

That’s a staggering jump in just a few years and it’s made the recent nosedive in paid efficacy that much harder to stomach.

As you know, Apple dealt a major blow Facebook ads with their iOS 14.5 privacy changes. Merchants reported Facebook ads are now 30% less effective.

But it wasn’t just Facebook. Respondents reported paid traffic effectiveness fell by 19% across the board.

Average ROAS across all platforms was 3.98x while median ROAS was 3.00x, surprisingly high numbers I thought given the events of the last year. Perhaps owners are over-estimating performance or they’ve simply dialed back their spend to smaller levels where it’s easier to generated stronger results.

Brands are 56% more likely to report paid channels as their top source of traffic compared to five years ago.

To spot-check these results I reached out to Common Thread Collective, a paid and digital marketing agency. They track ad performance on a benchmark of 200+ stores representing ~$275M in monthly spend.

MER (media efficiency ratio) as of June 2022 was down 6.59% compared to the same 2021 period. CAC (customer acquisition costs) over the same period was up 17.2%.

The CTC data is directionally similar albeit not quite as severe. This could be due to a number of reasons: MER being a better yardstick, professional campaign management for benchmark clients, differences in business size/models/etc. There’s a lot of variables but one indisputable takeaway:

Takeaway: Start diversifying to supplement paid traffic addictions. Costs will almost certainly continue to increase going forward.

(MER Footnote: The media efficiency ratio is calculated by dividing total revenue by total ad spend. It’s less precise but better at tracking the macro-level impact ad spending has on revenue.)

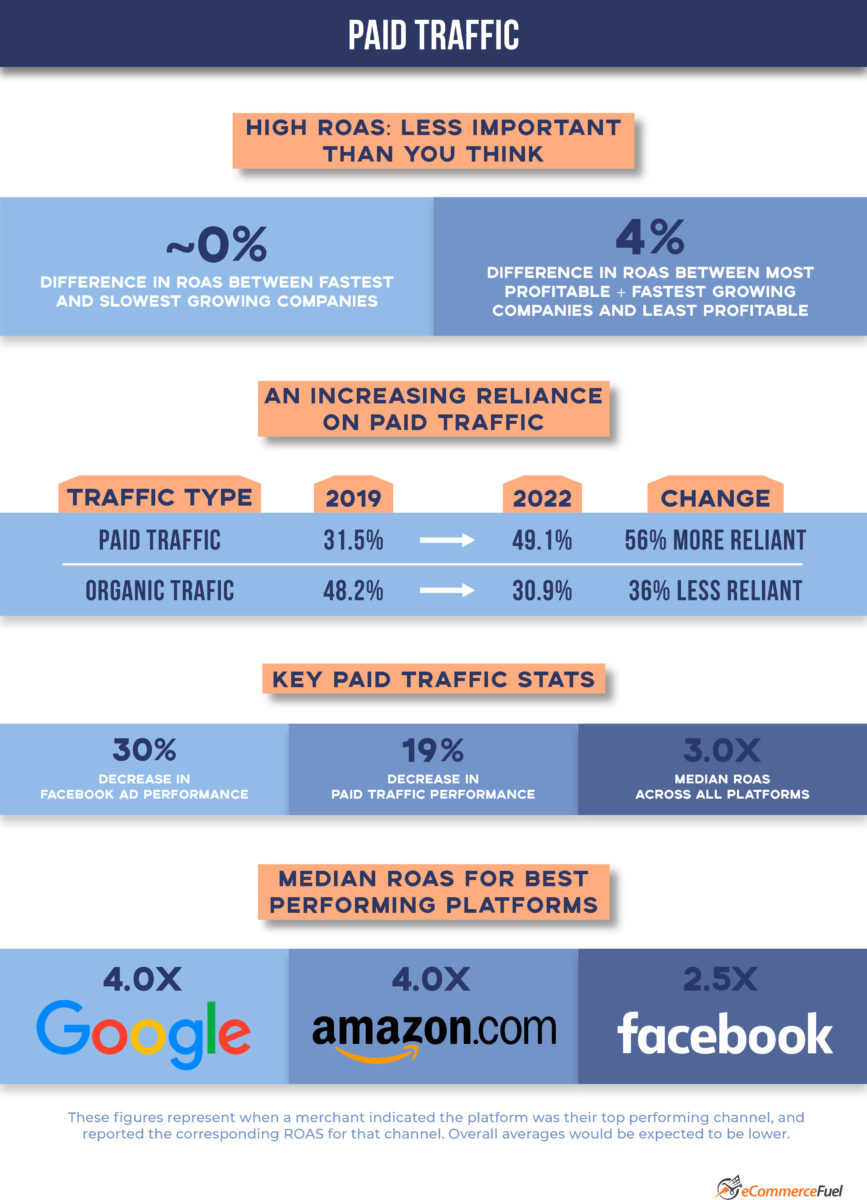

Influencer marketing made the biggest jump up on the popularity chart this year.

As search engines and platforms get more crowded/expensive, brands are increasingly tapping into the credibility and audiences of creators. In the eCommerceFuel Community we’ve watched eight-figure brands built quickly primarily off a savvy influencer marketing strategy.

SMS made its debut on the most popular chart. Email marketing remains the #1 most popular marketing channel but increasingly crowded inboxes are driving more marketers to use SMS.

According to Postscript, SMS messages have on average a 98% open rates and nearly 15% click-through rates, both exponentially higher than email.

Google jumped up a spot in the popularity rankings as stores reeling from the Apple/Facebook fiasco looked for alternative places to productively spend.

The big loser this year was (no surprise) Facebook falling in popularity from #2 to #4.

Blogging also fell a few spots, a trend I expect to continue. Blog posts require time and focus (both in short supply) and are competing directly (and losing) with short-form video. When was the last time you heard a millennial tell you about their favorite blog?

When was the last time you heard a millennial tell you about their favorite blog?

Enough about popularity, it’s really effectiveness we’re most concerned with. We measure effectiveness by comparing how popular something is relative to the number of brands citing it as a top ROI producer.

Amazon Ads once again claimed the crown for most effective marketing channel, despite increasing costs. AdWords also made a big jump in effectiveness this year.

Takeaways: Email marketing is still #1 but slipping in effectiveness. Amazon and Google remain the the best advertising options in terms of ROI.

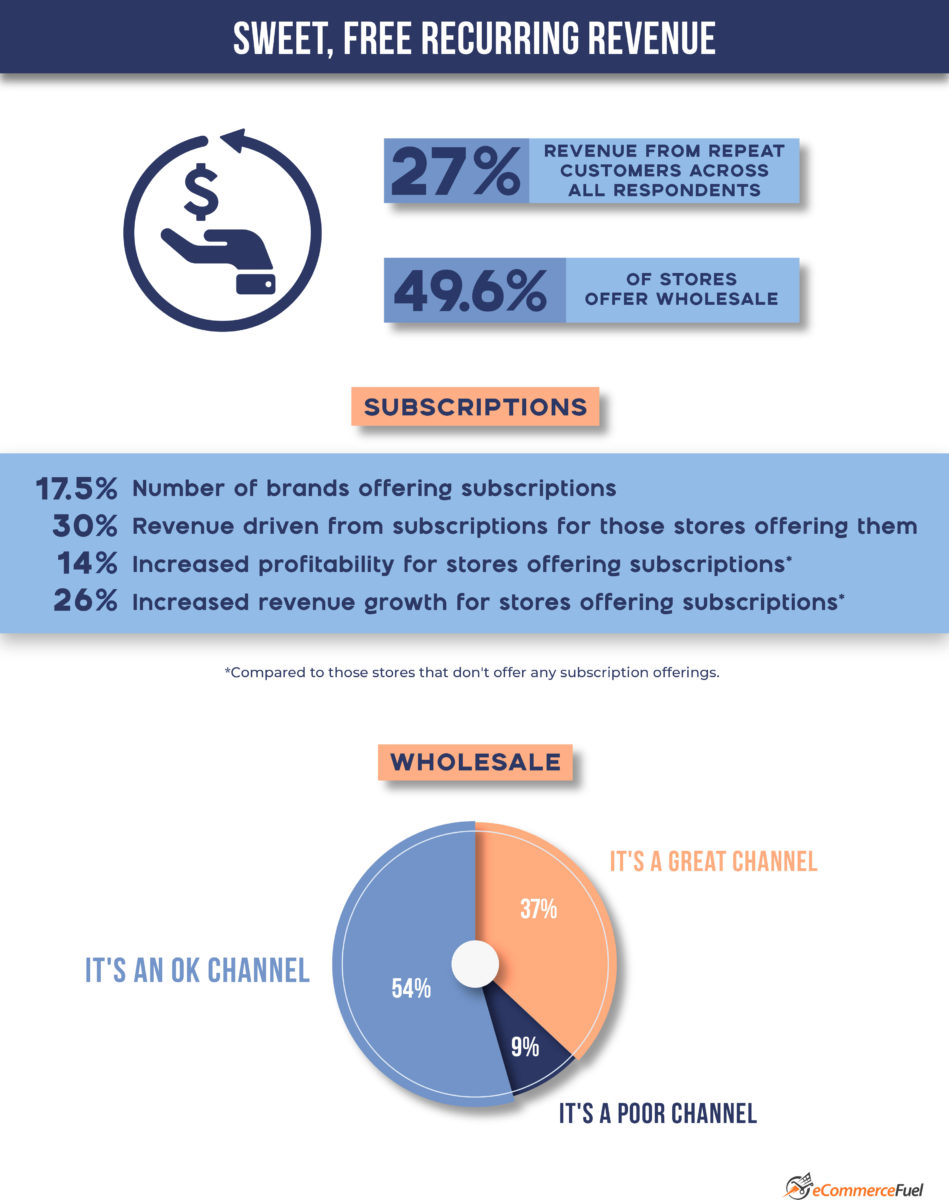

The increase in paid traffic costs has sparked renewed interest in non-paid channels and getting more revenue from existing customers. Subscriptions, wholesale, direct mail and upsells are all strategies merchants are employing.

Only 17.5% of brands generated any revenue from subscription offerings. Despite the allure of recurring revenue, lower CAC and higher LTVs, subscriptions can be tricky to make work. A brand needs a suitable product offering (diapers, yes; caskets, not so much) and customers are increasingly subscription weary.

When the fit is right it can be a major win: subscription sales generated 30% of the total revenue for brands offering it and brands offering subscriptions grew faster and were more profitable than those without.

Brands offering subscriptions grew 26% faster and were 14% more profitable than those who didn’t.

Wholesale advocates love the large order sizes and repeat business once relationship are established.

But is the hit to margins, potential credit risk offering terms and losing exclusive distribution of your product worth it?

For some, yes. Wholesale appears to be working reasonably well for a lot of merchants. Four times as many brands said it was a great channel vs. those who had a negative experience.

Like anything, the fit will depend on your product and industry. But for a meaningful segment of owners it’s working very well.

Four times as many brands said wholesale was a great channel vs. those who had negative experiences.

Direct mail wasn’t mentioned by merchants nearly as much as subscriptions or wholesale. Yet after years on the periphery, direct mail appears to be getting more attention.

Post Pilot recently cited a study from the Advertising Speciality Institute that 54% of marketing leaders increased their direct mail spend in 2022 while 76% saw their digital engagement decline.

Anecdotal case studies and reports this year from eCommerceFuel Community members also point to positive experiences. I’d be surprised if direct mail isn’t a more meaningful part of the discussion in next year’s report.

We didn’t ask specifically about upsells this year but they’re another popular strategy to earn more revenue from existing customer.

Zipify Apps, the maker of One Click Upsell reports merchants see an average 10-12% take rate on pre or post checkout upsells. When converted, they generate an AOV boost of $34 on average.

Takeaway: As paid acquisition costs rise, successful brands are having to learn how to earn more from their existing customers.

We always ask a slightly cheeky question in the Trends Report to take a break from the deluge of data. This year I think we’re weighing in on one of the greatest debates of all time:

Who was the best band from the 90s?

Collective Soul was the soundtrack that fueled an adolescence of rollerblading and MSN Messenger dial-up chats.

I have to be honest, I was disappointed with the results.

U2 and Pearl Jam are legends, of course, but Collective Soul was the soundtrack fueling an adolescence of rollerblading and MSN Messenger dial-up chats.

Seeing them come in last place is a blow and it’s the only time I’ve ever been tempted to fudge the data in this report.

In our last report, I predicted we’d hit peak Amazon and their market share among independent merchants would begin to slip. That’s what appears to be happening.

For the first time ever, the percentage of merchants selling on the Amazon – and the percentage of total sales via the platform – declined. It was a minor decline, dropping from 55.8% of brands selling on Amazon previously to 53.0% now. But it’s the first ever time fewer brands reported selling on Amazon.

For the first time ever the percentage of merchants selling on the Amazon declined.

Additionally, off-Amazon brands seem to be soundly besting their Amazon counterparts in most performance metrics including revenue growth, income growth and net margins.

Is this the END OF AMAZON!? No. Amazon isn’t going anywhere.

Everyone with the possible exception of Tobi Lütke shops at Amazon and brands leave money on the table by not selling on the platform.

Even without new growth from our primarily North American study contingent, Amazon will continue to grow as new merchants in Asia and across the globe increasingly join the platform.

Existing sellers aren’t planning on leaving. Only 8% of Amazon sellers in the study plan on leaving compared to a whopping 64% who said they’ll keep selling on the platform despite the increasing headwinds.

But I do think we’ve hit an inflection point.

I’ve never been an Amazon fan given the ever-increasing list of grievances: no access to customer data, random suspensions, hoards of sellers knocking off your product (including Amazon!) and other well-documented indignities.

Increasingly it seems future-minded owners who embrace branding, storytelling, unique products and less complexity are opting off the platform. I predict a gradual continuation of this decline in the years ahead.

Takeaway: Amazon has begun to slowly lose its allure with independent Western merchants.

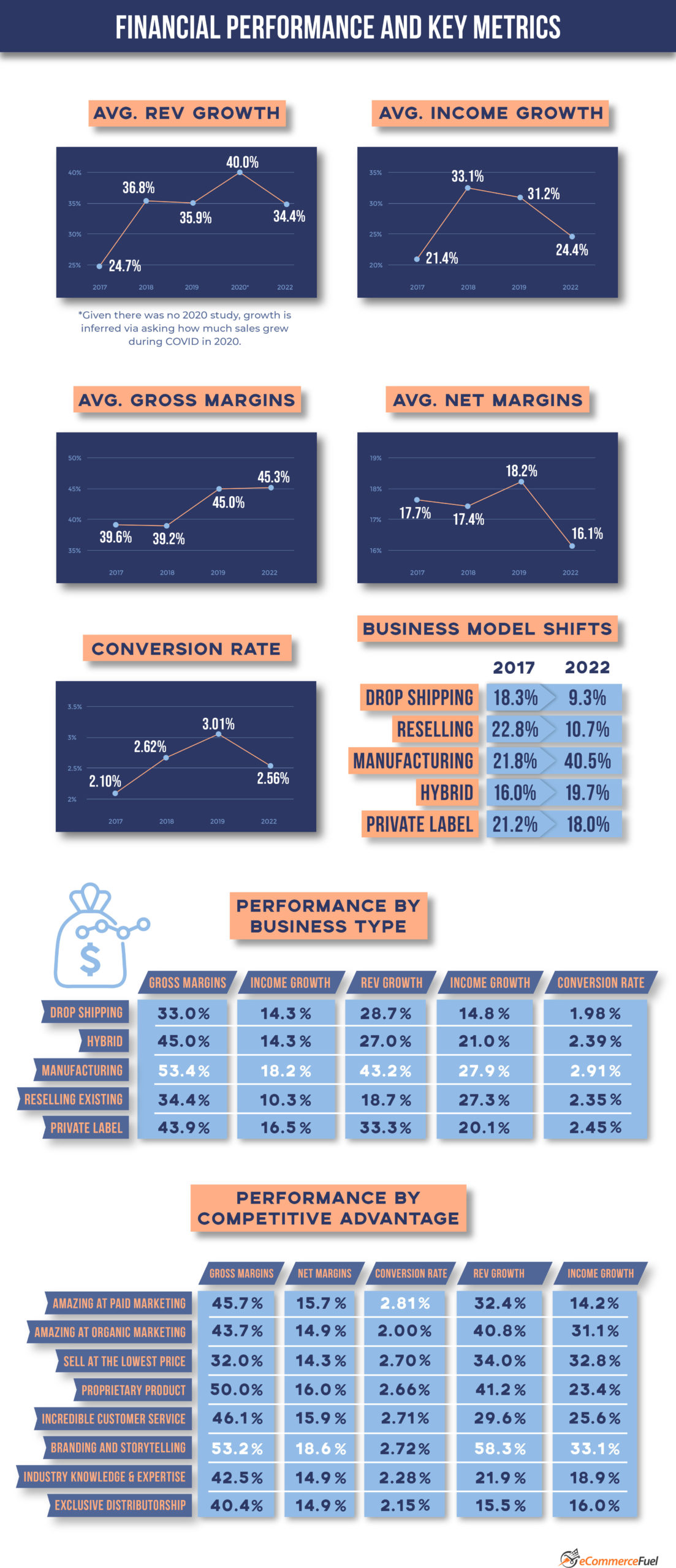

For those who aren’t data-processing nerds, let me highlight a few key takeaways in the stats above:

Net Margins are Compressing: Net profit margins (profit divided by revenue) compressed meaningfully, dropping from 18.2% to 16.1%. I’d speculate there are a couple things driving this: a) increased paid traffic reliance and costs and b) merchants raising retail prices more slowly than their suppliers – see the pricing section above.

Net margins compressed as merchants failed to increase prices at the same rate as their suppliers.

Conversion Rates are Down: After years of increases, conversion rates took a tumble dropping from above 3.00% to 2.56%.

This Spring, we saw a pullback in spending as stimulus money disappeared and people spent more on experiences/outings. I’ll be surprised if we don’t see conversion rates rebound next year assuming Monkeypox doesn’t take us out.

Manufacturing is Winning Big: Since 2017, the percentage of brands manufacturing their products doubled while drop shipping and reselling merchants were cut in half.

Drop shipping isn’t impossible in 2022. I know a number of merchants who drop ship successfully. It is, however, a small percentage of sellers who are able to differentiate enough to make the model work.

There’s a Magic Formula to Dominate: We compared key stats between different business types and competitive advantages and the winner was startling obvious: manufacturing as a model and branding/storytelling as a competitive advantage stole the show in nearly every metric.

If you’re starting a brand and don’t want to face an uphill battle keep this in mind.

In our 2022 predictions episode I said this year would be a record for eCommerce M&A given an extremely difficult 2021 (read: burned-out owners) and juicy multiples being paid.

It turns out selling was certainly top of mind: nearly a third of owners are seriously considering it or have decided to sell.

Then came a war in Ukraine, accelerating inflation, stock market volatility and a general shift in risk appetites as talk of a recession grew. Sentiments (and multiples) began to rapidly change.

The degree to which its impacted the eCommerce M&A markets is still being discovered.

I’ve heard first hand of multiple deals scraped due to macro conditions and guests on the podcast have spoken to this as well. It’s hard to separate anecdote from trend so we checked in with the team at Quietlight who sees a lot of deals.

Here’s their thoughts as of July 2022:

Despite a widely-predicted coming recession, the market for acquiring eCommerce businesses remains at historically high levels.

Where the aggregators have pulled back, other buyers have stepped in. Economic concerns do exist amongst some buyers, but not enough to turn the tides into a buyer’s market. It is still a strong sellers market…for now.

Economic concerns do exist amongst some buyers, but not enough to turn the tides into a buyer’s market. It is still a strong sellers market…for now.

Median multiples YTD for closed deals were 3.60x on SDE and 4.42 for SDE + inventory. For 2021 the multiples were 3.55x and 3.89, respectively.

The standard deviation on multiples paid has increased this year indicating buyers are become more picky. They’re still paying up for strong businesses but less likely to buy weaker stores.

…

The coming year will likely be challenging for many brands.

Many are still wrestling with higher acquisition costs as adjusting takes time, investment and change. Consumer demand has softened, financing costs are higher and hiring good talent remains a challenge.

Thankfully, if human history is any indication we won’t stop buying things. And we increasingly turn online when it’s time to spend.

The key tenants of success, however, are changing. For years (decades?) it was possible to “hack” acquisition by leveraging uncrowded channels with outsized ROI. Now, the era of exclusively leveraging paid traffic to build online companies is waning.

The era of exclusively leveraging paid traffic to build companies is waning. Most brands paying for 100% of their traffic and attention will struggle to stay afloat going forward.

Instead, we need to focus on build companies people love, naturally talk about and return to willingly.

This requires noteworthy products, compelling relationships and brand affinity that drives repeat business and word-of-mouth referrals. Most brands paying for 100% of their traffic and attention will struggle to stay afloat going forward.

We’re entering a period that favors smaller, interesting and more personal brands targeting smaller markets. When done well, the deep connection and rapport drives CPAs down and keep profits in the black.

These brands will be harder to build and scale but will almost certainly be more durable. I’m excited to see the brands, products and creative new voices that emerge.

….

Congratulations to Tony Spencer from NotSleepy.com! He was the winner of the airline ticket anywhere in the world, awarded each year to one lucky study participant. A huge thank you to him and, again, to everyone who participated in this year’s study.

Thank you as well for your patience with the Trends Report over the last few years as careful observers will notice the gap during 2020/2021.

This report is a massive undertaking and given the events of the last few years we failed to get it done. Our gratitude to everyone who returned to participate and read it again this year – thank you.

Own a 7- or 8-Figure eCommerce Business?

Then you should join us inside eCommerceFuel, the world’s largest community for 7- and 8-figure brand owners. Why?

Learn What’s Working to Grow Your Business

All our members are vetted 7- and 8-figure business owners with deep experience. Find out what’s working (and what’s not), get fast answers to your questions and tap into an unrivaled braintrust.

Avoid Costly Hiring and Tech Mistakes

Shopping for a new ERP? Hiring a new agency? Getting it right can be a huge win. But getting it wrong can mean countless hours and thousands of dollars lost.

Upon joining you get access to over 20,000 member reviews on everything from SMS tools to paid traffic agencies so you can make informed decisions and avoid costly mistakes.

And Much More

Get exclusive discounts on more than 100 eCommerce SaaS tools, invites to member-only events and much more.

Apply now and start growing your business with deep insights from other 7- and 8-figure owners. We’d love to have you join us!

30-day trial for just $1

- Vetted, active discussion forum

- Invites to member-only events

- Thousands of unbiased reviews

- Discounts on 125 SaaS Apps

- Network of 1,000+ store owners

- Local and conference meetups

Our 10x ROI Guarantee

Our 10x ROI Guarantee